The IMF’s latest economic assessment of Germany, or Article IV consultation, recommends policy action to minimize the longer-term impact of the COVID-19 pandemic and to facilitate a greener and more inclusive recovery.

The following five charts illustrate the effects of the pandemic on Germany and the policies necessary to support a sustained recovery while building better for the future.

- A robust recovery is expected in the second half of 2021 as the mass vaccination effort gathers steam, though large uncertainties remain. Germany’s economy contracted by just under 5 percent in 2020, outperforming most European peers. New waves of infections and associated lockdowns during late-2020 to early 2021 hampered the rebound from the first wave. But forward-looking indicators suggest further growth in exports and a brightening outlook for the services sector, in line with re-opening plans and anticipated pent-up demand. For the year as a whole, growth of about 3.6 percent is expected. The recovery path, however, is beset with risks, particularly regarding the progress of the pandemic and supply shortages in key industries.

- Retaining supportive fiscal policy until there is clear evidence of a sustained recovery while also using the fiscal space to lift potential growth over the medium term will be crucial. The government has extended various COVID-19 measures from 2020, such as grants to firms and an expansion of the short-time work subsidy, while also introducing several new measures to support households and businesses. Maintaining adequate support while the economy is still weak is important to minimize scarring effects. As the recovery firms up, more targeted policies and a focus on facilitating resource re-allocation becomes important. Over the medium term, it is important that Germany’s fiscal space is used to boost growth potential by investing in physical and human capital, accelerating digitalization, incentivizing innovation, bolstering labor supply, and increasing disposable income for low-income households. Making progress towards these goals would also help with external rebalancing.

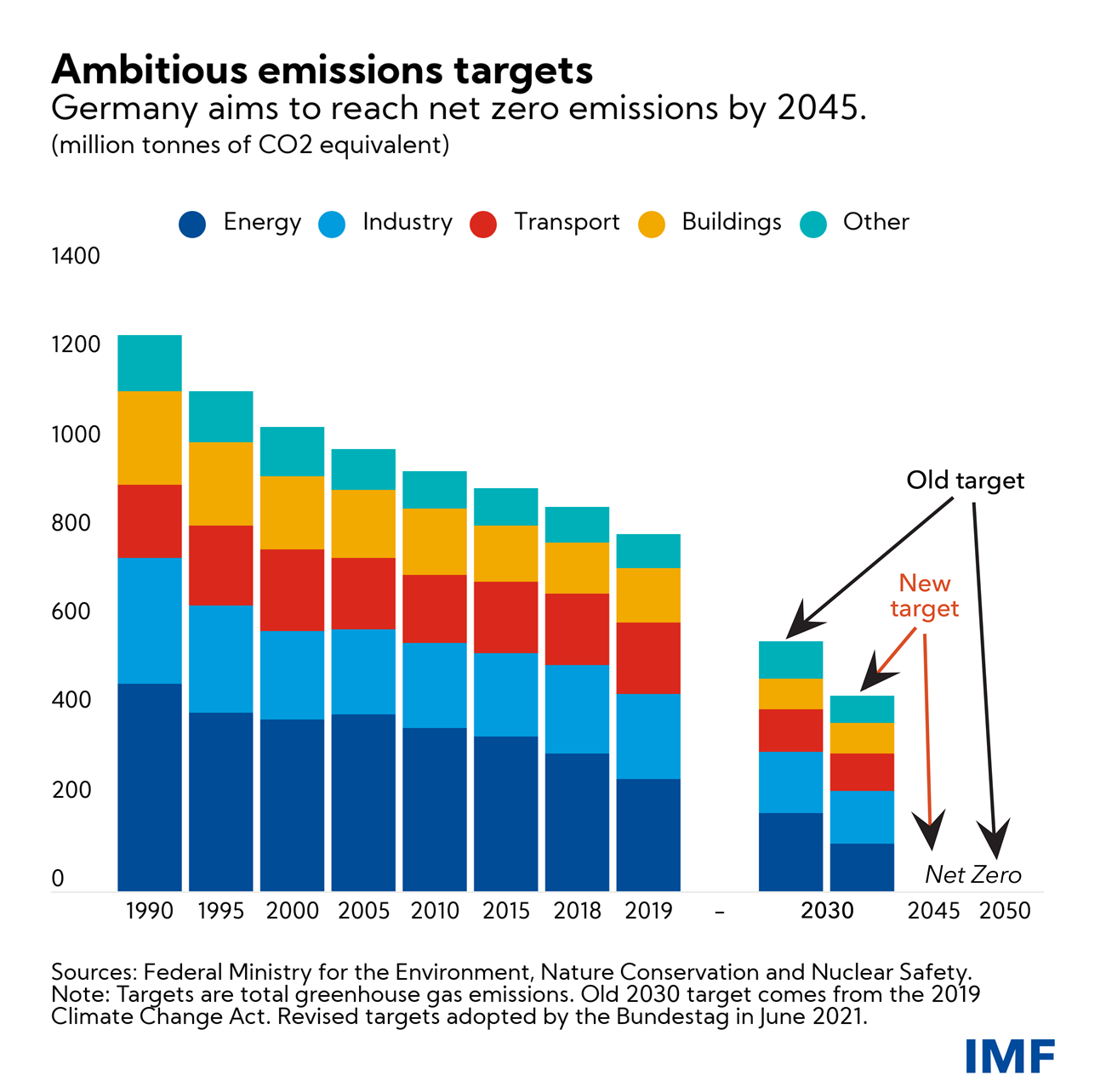

- A green transition is key to Germany’s recovery program, yet there are opportunities to improve the cost-effectiveness of its climate mitigation measures. Following a constitutional court ruling in May, Germany tightened its greenhouse gas emissions targets aiming for a 65 percent reduction by 2030 and net zero emissions by 2045. Germany could bolster its mitigation program with a better-specified schedule of carbon prices over a longer time horizon, complemented with sector-specific feebates (revenue-neutral tax/subsidy schemes). Continued government support for green infrastructure and technologies is also essential for the transition and to spur the economic recovery. To mitigate the potential adverse impact of higher carbon prices on households, further relief targeted at lower-income earners can be considered.

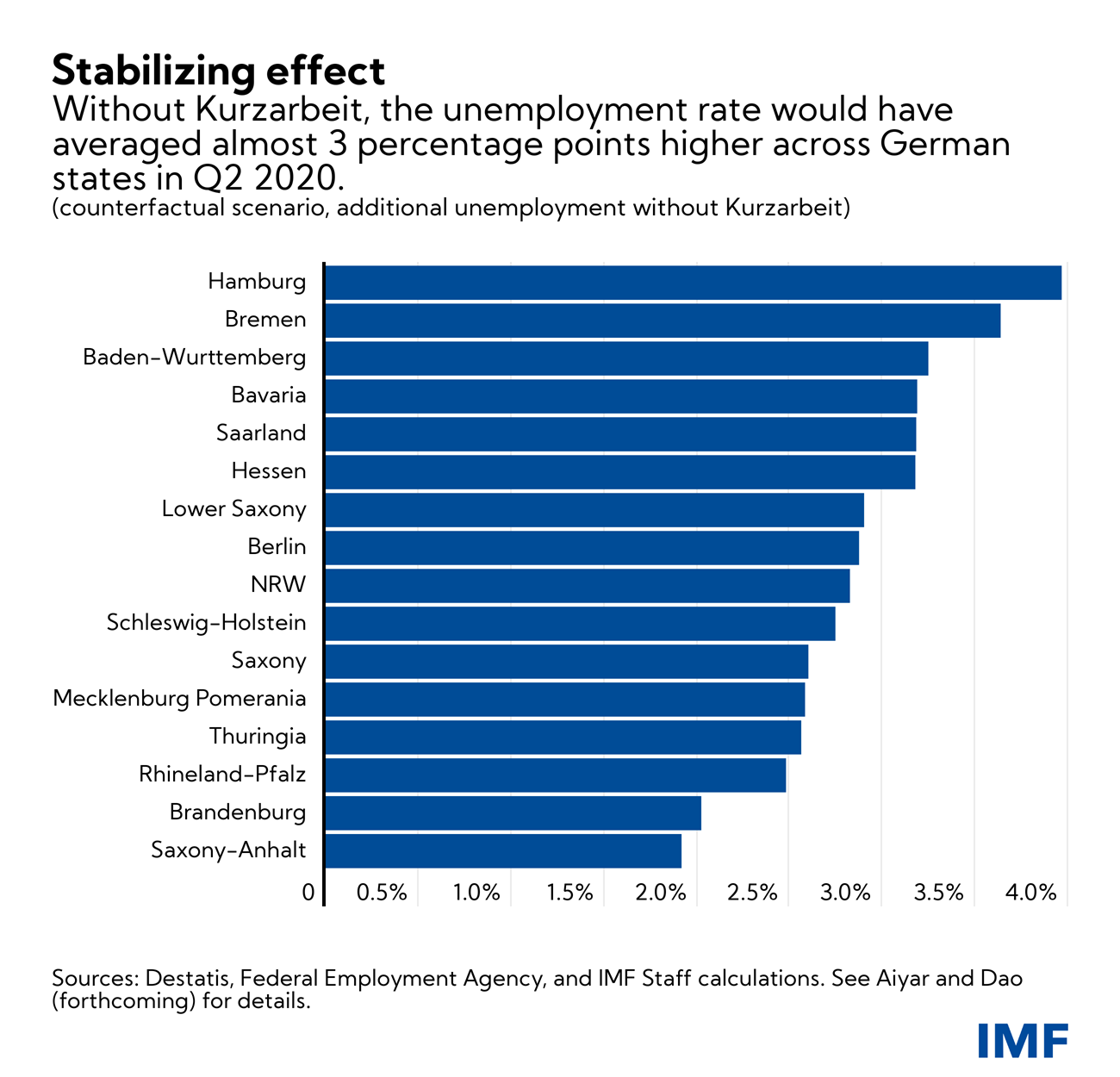

- Germany’s expanded short-time work subsidy or Kurzarbeit remains important until the recovery takes hold, while groups not covered by Kurzarbeit need to protected by different means. The unprecedented take-up of Kurzarbeit helped keep unemployment in check and supported aggregate demand. However, as the recovery takes hold, normalizing Kurzarbeit parameters becomes essential so as not to inhibit labor reallocation toward growing firms and industries. Job search assistance and appropriate training programs can facilitate workers’ transition into post-pandemic jobs. For groups not covered by Kurzarbeit, maintaining expanded access to the current basic income program would be beneficial until the job market recovers sustainably. To arrest widening inequality, the government could consider reducing social security contributions on lower incomes, which would also spur hiring and labor supply.

- Safeguarding financial stability during the nascent recovery is essential. So far bankruptcies and financial losses have been limited, while bank capital has actually increased since the onset of the pandemic. But bankruptcies may rise as support measures are phased out, warranting continued targeted liquidity and solvency support for viable firms. Meanwhile, specifying an appropriately gradual timetable for banks to rebuild capital buffers is important to mitigate the risk of curtailed lending when it is most needed. Banks also need to improve their cost structures to address chronic low profitability. Progress has been made in narrowing data gaps that have hampered the full assessment of macro-financial risks. But the buildup of financial vulnerabilities in real estate markets calls for close monitoring and for expanding the macroprudential toolkit to include income-based instruments.

Public Release.

More on this here.