Washington, DC: The International Monetary Fund released the results of the thirteenth annual Financial Access Survey (FAS) [1] which presents the 2021 data and highlights the continued expansion in the use of digital financial services-considerably higher than pre-pandemic levels. The survey also shows a decline in the balances of outstanding loans to SMEs and persistent gender gaps in financial access for many economies. Microfinance institutions played an important role in some economies promoting the inclusion of unserved and underserved populations, including by channeling pandemic support.

The access and use of digital financial services continued to expand

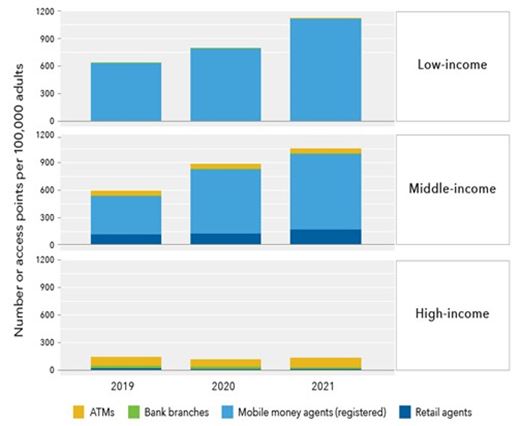

The pandemic has disrupted the traditional way of accessing financial services, prompting greater use of digital finance. The FAS data show a transition from traditional financial access points such as bank branches and ATMs to mobile agents and retail agent outlets in some developing economies since the onset of the COVID-19 pandemic. The usage of digital financial services has also increased, with the value of mobile money transactions growing from about 40 percent of GDP to 70 percent in low-income countries, and the value of mobile and internet banking transactions increasing from 225 percent of GDP to 324 percent in middle-income countries between 2019 to 2021.

New ways to access finance is gaining momentum

Source: IMF Financial Access Survey and IMF staff calculations.

Note: The chart shows the weighted average of four types of financial access points by country income group for countries whose data are available for 2019-2021. Country coverage differs across the types of financial access points.

At the same time, traditional financial services remain important for financial inclusion. For example, the share of depositors continued to grow in all country income groups. On the other hand, the aggregate values of outstanding loans and deposits as a share of GDP were mostly unchanged between 2020 and 2021 for all country income groups, although outstanding loans declined slightly in middle- and high-income countries in 2021.

Outstanding loans to SMEs decreased in most economies

Small and medium enterprises (SMEs) play an important role in many economies but often face greater constraints in accessing finance. The FAS data show that more than 70 percent of the economies which submitted SME data to the FAS in this round experienced a decline in outstanding commercial bank loans to SMEs in 2021. This was a reversal from the 2020 trend, where SME loans remained stable or even increased in many economies. At least partly, this appears to be due to the unwinding of policy measures adopted in response to the pandemic such as loan assistance and wage subsidies.

Gender gap in financial access persists in many economies

The latest FAS data show that the gender gap in financial access persisted in many economies in 2021. In 2020, outstanding deposits increased for both men and women. However, the increase was reversed in 2021, likely due to the end of policy measures adopted during the pandemic to support financial access. The decline in deposits was greater for women than for men in 45 percent of the economies that reported gender disaggregated data. The number of deposit accounts, on the other hand, stayed broadly stable or even increased in some countries for both genders in 2021. These findings reinforce the need for continued collection and monitoring of gender disaggregated data on financial access.

[1] The FAS is a unique supply-side database on access to and use of financial services, including digital financial services and gender-disaggregated data. It covers 189 economies, with 121 data series and historical data from 2004. The latest FAS data with country-specific metadata are available at https://data.imf.org/FAS, and the 2022 FAS Trends and Development can be downloaded here . The 2022 FAS was made possible with the generous support of the Data for Decisions (D4D) Fund .